Advisor transitions have become a hot topic in relation to digital transformation. More advisors are transitioning and are seeking innovative firms that help them meet the needs of their clients. But that’s not the only factor — The Complete Guide to Financial Advisor Transitions walks you through the many trends and considerations that are driving our industry forward.

Spanning 6 chapters, you can download the report in full here:

For those curious about what our report holds, here are the top 3 insights.

1. M&A Trends are contributing to the need for a better transition process

Firms are looking to grow. While organic growth has always been the backbone of wealth management, inorganic (or acquisition-led) growth is ramping up. The last quarter of 2020 set a record for the number of acquisitions, and data is showcasing this year has not slowed down.

Acquiring firms must keep in mind the process of the firms they are acquiring as they transition their book of business. Additionally, larger firms are able to provide a more powerful tech stack to their advisors. With nearly 20% of clients not following their advisor during the transition process, the need for a better transition process is paramount for client retention and advisor success.

2. Your Technology Choices Matter

The COVID-19 pandemic showed us digital-first experiences can no longer be a nice to have. Clients expect a modern experience in wealth management, and those firms who are failing to deliver are losing ground.

However, advisors have felt the sting of poorly integrated or poorly architected systems, and nearly 3/4ths of transitioning advisors note learning new technology was a top anticipated challenge. How does a firm make the right technology choices to support their advisors?

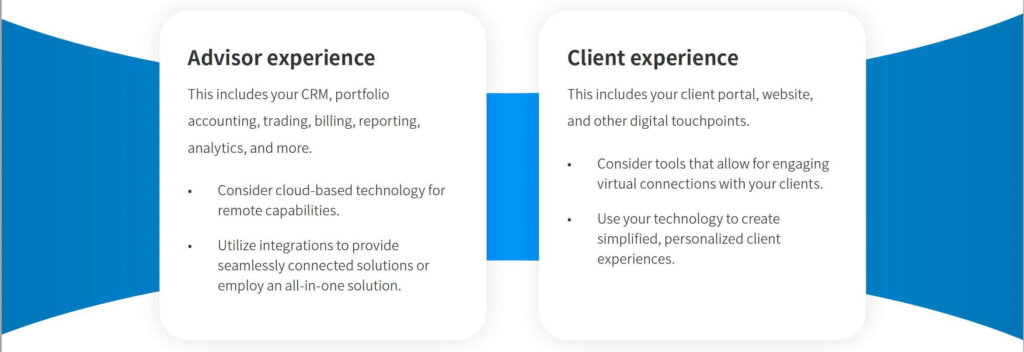

They must consider two primary categories — the advisor experience and the client experience. Check out this expert from our white paper:

Ultimately, all-in-one tech solutions that integrate with other tools are leading the pack in terms of preference and choice. Inefficient systems and incorrect data create poor experiences for your advisors and deliver an even worse experience for their clients.

3. Advisors Value Good Customer Experiences

At the end of the day, an advisor is there for their clients — and as such, their tech stack should support their customers. With younger, more tech-savvy investors, for advisors to delight their clients, they will always seek out better solutions that drive a better client experience.

From partner portals, eSign capabilities, and integrated systems, these features are no longer nice to haves — clients expect the same experiences with their wealth management firms as they receive with any other service. With the right technology, it isn’t only the client who benefits.

Back-office staff are able to find errors faster, streamline communication, and ultimately deliver fewer NIGOs.

Executive and leadership staff can track how much of a book of business has been transitioned and understand where slowdowns are occurring in the process.

Lastly, advisors themselves are able to understand where they need to focus their energy during the transition process — and when the time comes, open accounts in a more streamlined manner.

If you’re ready to learn more, read The Complete Guide to Financial Advisor Transitions today!

Skience is powering the best and brightest in the industry. If you want to learn more about our Advisor Transitions offering, check it out here. If you want to see how we can help you, schedule a demo today!